ENS Financials and Valuation

Despite my bullish growth projections, I’m skeptical that ENS is an investable asset given its status as a public goods organization. The price target modeling was mostly just a practice exercise in fundamental valuation, so please take it with a grain of salt.

Nonetheless—read on for why ENS revenue can potentially compound at a ~45% 5Y CAGR and capture 5% of the domain name market.

Intro

Problem: User IDs are represented by wallet addresses (e.g., 0xf0f5…94b9), which are inconvenient to communicate, much like IP addresses as a representation for a website.

Solution: ENS is the web3 analog of a domain name registry service like Verisign. It leverages smart contracts to map human-friendly names (e.g., ericwallach.eth) to blockchain addresses , decentralized websites, and the like. Unlike ICANN, ENS cannot revoke an ENS name - users have full control.

Use Cases

Web3 IDs: Resolution of names to blockchain addresses enables cross-platform web3 IDs. The simplest use-cases include single sign-on and payments (e.g. a friend can more easily recall and transfer money to ericwallach.eth than a random 42-character wallet address).

Decentralized social profiles: ENS names can serve as more than simple social profile handles due to multi-address/multi-resource functionality. For example, a user can link his ENS name to an NFT avatar, blockchain address(es) for payment, websites, Twitter handles, and email addresses. This data can even be paired with e.g., a PhotoChromic soulbound NFT for biometric identity attestation. The social profile can then be imported into a messaging application like dm3 via single-sign on.

Decentralized Websites: Resolution of ENS names to IPFS-hosted files enables decentralized and censorship-resistant websites that can withstand censorship/seizure attempts against the VPS host (e.g., Digital Ocean), the domain registrar (e.g., NameCheap), etc.

KPIs

ENS usage is growing across number of unique owners, names-per-owner, and integrations.

Unique owners (addresses) increased +126% Y/Y to 737K (463% 2Y CAGR).

Domains-per-owner (address) increased +149% Y/Y to 4.50 (123% > 4Y avg.), which bodes well after 2 down years.

Integrations increased +53% Y/Y to 508 (72% 2Y CAGR)

Consistent growth in the number of ENS domain owners and domains-per-owner continues to drive impressive growth in registrations, renewals, and premiums.

Domain Base is up +487% Y/Y to 2.59M (483% 2Y CAGR)

Domain Registrations are up +477% Y/Y to 2.29M (611% 2Y CAGR)

Renewals are up +265% Y/Y to 251K (119% 2Y CAGR)

Temp Premiums are up +873% Y/Y to 54K (412% 2Y CAGR)

Revenue increased +128% Y/Y to $63M (470% 2Y CAGR)

Registration revenue increased +97% Y/Y to $63M (553% 2Y CAGR)

Renewal revenue increased +250% Y/Y to $9M (312% 2Y CAGR)

Temp premium increased +348% Y/Y to $8M (395% 2Y CAGR)

Web3 IDs (~18%): Primary Name registration increased +146% Y/Y to 458K (210% 2Y CAGR). The ENS Primary Name is what enables an ENS name to serve as a web3 ID, so the share of ENS names with their ENS Primary Name record set is a proxy for organic demand as opposed to speculation/squatting. While the growth here is encouraging, it still only represents ~18% of the 2.59M ENS domain stockpile. Said differently, 82% of ENS names are likely purchased with little-to-no intention of real usage.

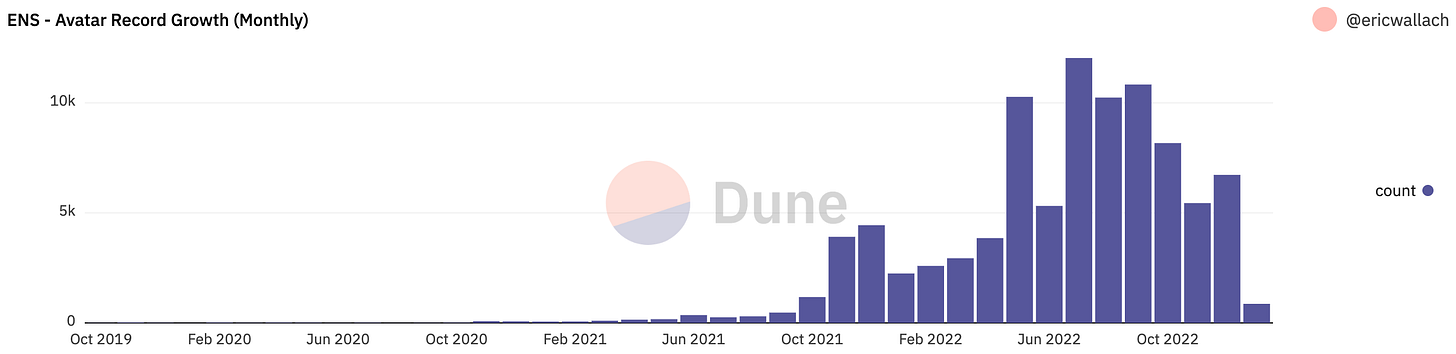

Decentralized Social Profiles (<3%): The number of unique avatars increased +716% Y/Y to 74.51K but still only represents <3% of the ENS domain base or ~15% of those with an ENS Primary Name. The uptake is even bleaker for Twitter profiles, URLs, emails, and Discords, with respective penetration rates at or below 1% of ENS domains.

Decentralized Websites (~1%): Decentralized websites exhibited modest growth of 57% to 36.53K. This represents only ~1.41% of the 2.59M ENS domain name stockpile or 17.69% of ENS Primary Name records.

Valuation

Overview - ENS DAO Token

Value Accrual (or Lack Thereof): ENS tokens represent (delegatable) voting rights in ENS DAO, and hence the right to vote on financial decisions with respect to the DAO Treasury. The DAO Treasury accrues 100% of fee revenue, which ENS charges to discourage squatting and fund long-term R&D. Although many people expect e.g., Uniswap to eventually pay dividends to its shareholders, the same is not true of ENS. Most people recognize that the likelihood of future ENS dividends or share buybacks is low regardless of growth.

ENS was founded as a “public goods” organization, and as such, voting rights are explicitly limited in scope.

Example 1: ENS DAO can change the registration/extension costs of all names according to transparent criteria (e.g., domain name length), but it cannot alter these costs to the benefit or detriment of select groups of domain name owners (e.g., those with 3-character domain names).

Example 2: ENS DAO cannot charge users for claiming DNS-ENS domains, because “such a fee would be purely an income generating measure and not an incentive mechanism.”

Of course, a sufficiently motivated coalition of ENS holders might try to amend the ENS DAO Constitution in the future, but it is unlikely to work. Nick Johnson (ENS co-founder, primary author of the ENS DAO Constitution, 4th most powerful ENS delegate, etc.) is unequivocal that ENS is a public good [1]. I suspect web3 users would overwhelmingly rally around a community-oriented fork, severely diminishing the expected value of any dividends. The odds are better for ENS share buybacks using the Treasury.

Domain Name TAM

I project domain name TAM to reach $11bn by FY28 (~11.32% CAGR)—excluding add-on products/services offered by many domain registrars. Domain renewals/retention currently account for 73% of revenue, and that share will increase to 84% by FY28.

ENS is well-positioned to capture share in the nearly ~$11bn domain name market. At 2.59M registrations, it is highly competitive with popular gTLDs (e.g., 21% of .xyz and 31% of .info) and popular Generic TLDs (e.g., 12% of .net and 16% of .org), yet only 1.09% of .com registrations and 0.40% of the entire 350M stock of domain names (excluding country TLDs), which I predict will reach 443mm by FY28 (4.15% CAGR). In short, ENS is large enough relative to gTLDs that it should be taken seriously, but small enough relative to Generic TLDs that most growth will lie ahead.

Valuation Model I - Historical .com Growth

Overview: In this first model, I base future ENS adoption on historical gTLD domain base growth—a 36% CAGR from FY01-FY22. This is also roughly the same CAGR as early .com registrations from 1999-2005—when .com registrations were similar in absolute terms to current ENS registrations.

Revenue: I project that ENS DAO will generate ~$595M in annual revenue by FY28. This will represent ~5% of the estimated ~$11B TAM. Renewal fees fees will increasingly become the dominant driver of revenue as fewer premium domains remain unregistered.

Expenses: I keep it simple and assume 5%/year cost inflation over time. A major benefit of ENS’ positioning as a public goods organization is that it does not need to internalize the costs of R&D like Verisign.

Valuation: I assume a 25x P/E multiple for ENS comparable to Verisign’s, but the multiple should arguably be much smaller given the nature of ENS as a non-profit. For the sake of this exercise, I expect ENS price to hit ~$122 with 460% upside from current levels.

Valuation Model II - Internet Penetration and Coinbase Account Growth

In this second model, I project future ENS adoption based on growth in the number of Coinbase users (an imperfect proxy for crypto users), and I project Coinbase user growth as a % of global Internet users.

First, I assume that 76% of the world population will be using the Internet by FY28, and that the number of Internet users with a Coinbase account will increase from 108M (~2% share) to 194M (3% share) over that same horizon.

Second, I assume that the ratio of unique ENS addresses to Coinbase accounts will increase from 1% to 7%, particularly as web3 usage shifts from HODL’ing ETH in a Coinbase account to using that ETH in dApps, etc. (I believe this will follow from the close Coinbase x ENS partnership.)

Third, I assume that each ENS address will own on average 3-4 domains. This average is skewed heavily by speculators and squatters.

Now we can estimate the number of new ENS registrations from Coinbase users and use the historical distribution of registration-years for new domain names to predict renewals, releases/expirations, etc.

Conclusion

FY28 revenue target of $570M in Model II (44% CAGR) vs. $595M in Model I (45% CAGR)

5Y price target of $117 in Model II (437% upside) vs. $121 in Model I (460% upside)

Both models w/in small margin of error!